What You Need To Know About Full Coverage Insurance State Farm

When it comes to securing your vehicle, full coverage insurance State Farm stands out as a top choice for drivers across the United States. With a reputation for reliability and customer satisfaction, State Farm has become a household name in the insurance industry. Full coverage insurance provides a comprehensive safety net, ensuring that your vehicle is protected against a wide range of risks, from accidents to theft. Whether you're a new driver or a seasoned road warrior, understanding the nuances of full coverage insurance can save you time, money, and stress in the long run.

Full coverage insurance State Farm typically includes liability coverage, collision coverage, and comprehensive coverage. These components work together to safeguard you financially in the event of an accident, damage, or loss. Liability coverage pays for damages you cause to others, while collision coverage handles repairs to your vehicle after a crash. Comprehensive coverage, on the other hand, protects against non-collision-related incidents like theft, vandalism, or natural disasters. This layered approach ensures that you're prepared for almost any situation on the road.

Choosing the right insurance provider can be overwhelming, but State Farm's extensive network of agents and user-friendly online tools make the process straightforward. With customizable policies, competitive rates, and 24/7 customer support, State Farm aims to meet the unique needs of every driver. In this article, we'll dive deep into the benefits, costs, and frequently asked questions about full coverage insurance State Farm, helping you make an informed decision for your vehicle's protection.

Read also:What Kind Of Cancer Did Melanie Olmstead Have A Comprehensive Guide

Table of Contents

- What is Full Coverage Insurance?

- Why Choose State Farm for Full Coverage?

- What Are the Benefits of Full Coverage Insurance?

- How Much Does Full Coverage Insurance Cost?

- What Does Full Coverage Insurance Include?

- Is Full Coverage Insurance Right for You?

- How to Save on Full Coverage Insurance

- Frequently Asked Questions

What is Full Coverage Insurance?

Full coverage insurance is a term often used to describe a policy that combines multiple types of coverage to provide comprehensive protection for your vehicle. While the exact components can vary depending on the provider, full coverage insurance State Farm typically includes liability coverage, collision coverage, and comprehensive coverage. This combination ensures that you're protected in a wide range of scenarios, from accidents to unforeseen events like theft or weather damage.

Liability coverage is a critical component of full coverage insurance. It pays for damages or injuries you cause to others in an accident. Most states require drivers to carry a minimum amount of liability coverage, but full coverage insurance State Farm often exceeds these minimums to provide additional peace of mind. Collision coverage, on the other hand, covers the cost of repairs to your vehicle if you're involved in an accident, regardless of who is at fault. This is particularly valuable if you own a newer or more expensive vehicle.

Comprehensive coverage rounds out the package by protecting your vehicle against non-collision-related incidents. This could include theft, vandalism, fire, or damage caused by natural disasters like hail or floods. Together, these components create a robust safety net that ensures you're financially prepared for almost any situation. While full coverage insurance State Farm may come with a higher premium, the peace of mind it offers often outweighs the cost.

Why Choose State Farm for Full Coverage?

State Farm has earned its reputation as a leading insurance provider through decades of experience, a vast network of agents, and a commitment to customer satisfaction. When it comes to full coverage insurance State Farm offers several advantages that set it apart from competitors. One of the standout features is its extensive agent network. With thousands of local agents across the country, State Farm makes it easy to get personalized advice and support tailored to your specific needs.

Another reason to choose State Farm is its user-friendly online tools and mobile app. These resources allow you to manage your policy, file claims, and get roadside assistance with just a few clicks. The company also offers 24/7 customer support, ensuring that help is always available when you need it most. Additionally, State Farm's Drive Safe & Save program rewards safe drivers with discounts, making full coverage insurance more affordable over time.

State Farm's financial strength is another key factor to consider. With high ratings from independent agencies like A.M. Best and Standard & Poor's, State Farm has the resources to pay claims promptly and reliably. This financial stability gives you confidence that your policy will be there when you need it most. Whether you're looking for competitive rates, excellent customer service, or innovative tools, State Farm's full coverage insurance is a strong contender.

Read also:Discovering The Wild A Journey Through Timothy Treadwell Audio

What Are the Benefits of Full Coverage Insurance?

Full coverage insurance State Farm offers a range of benefits that make it an attractive option for drivers. One of the most significant advantages is the peace of mind it provides. Knowing that you're protected against a wide variety of risks allows you to drive with confidence, whether you're commuting to work or embarking on a road trip. This comprehensive protection can be especially valuable if you own a newer or more expensive vehicle, as repair or replacement costs can quickly add up.

Another benefit is the flexibility to customize your policy. State Farm allows you to tailor your coverage to suit your specific needs, whether that means increasing your liability limits or adding extras like roadside assistance or rental car reimbursement. This customization ensures that you're not paying for coverage you don't need while still getting the protection you do. Additionally, State Farm's bundling options let you save money by combining your auto policy with other types of insurance, such as home or life insurance.

Full coverage insurance State Farm also includes access to valuable perks like accident forgiveness and diminishing deductible programs. Accident forgiveness ensures that your rates won't increase after your first at-fault accident, while diminishing deductible reduces your out-of-pocket costs for each claim-free year. These features add extra value to your policy and make State Farm a standout choice for full coverage insurance.

How Much Does Full Coverage Insurance Cost?

The cost of full coverage insurance State Farm can vary widely depending on several factors, including your location, driving history, and the type of vehicle you own. On average, full coverage insurance tends to be more expensive than liability-only policies due to the additional layers of protection it provides. However, the exact cost can range anywhere from $100 to $300 per month, depending on your specific circumstances.

Several factors influence the cost of full coverage insurance State Farm. Your driving record is one of the most significant, as drivers with a history of accidents or traffic violations typically pay higher premiums. The type of vehicle you drive also plays a role, with newer and more expensive cars costing more to insure. Additionally, your location can impact your rates, as areas with higher rates of theft or accidents often have higher insurance costs.

Despite the higher upfront cost, full coverage insurance State Farm can save you money in the long run by protecting you from costly repairs or replacements. To make it more affordable, State Farm offers a variety of discounts, such as safe driver discounts, bundling discounts, and discounts for students with good grades. By taking advantage of these savings opportunities, you can enjoy the benefits of full coverage insurance without breaking the bank.

What Does Full Coverage Insurance Include?

Full coverage insurance State Farm is a comprehensive package that includes several key components designed to protect you and your vehicle. Understanding what each component covers is essential to making the most of your policy.

Liability Coverage

Liability coverage is a foundational element of full coverage insurance State Farm. It pays for damages or injuries you cause to others in an accident, including medical expenses, lost wages, and legal fees. Most states require drivers to carry a minimum amount of liability coverage, but full coverage insurance often exceeds these minimums to provide additional protection. For example, if you're involved in an accident and found at fault, liability coverage will help cover the costs of repairing the other driver's vehicle and any medical bills they incur.

Collision Coverage

Collision coverage is another critical component of full coverage insurance State Farm. It pays for repairs to your vehicle if you're involved in an accident, regardless of who is at fault. This coverage is particularly valuable if you own a newer or more expensive vehicle, as repair costs can quickly escalate. For instance, if you collide with another vehicle or hit a stationary object like a tree or guardrail, collision coverage will help cover the cost of repairs or replacement.

Additionally, full coverage insurance State Farm includes comprehensive coverage, which protects your vehicle against non-collision-related incidents. This could include theft, vandalism, fire, or damage caused by natural disasters like hail or floods. Together, these components create a robust safety net that ensures you're financially prepared for almost any situation.

Is Full Coverage Insurance Right for You?

Deciding whether full coverage insurance State Farm is the right choice for you depends on several factors. If you own a newer or more expensive vehicle, full coverage insurance is often a wise investment. The cost of repairs or replacement can be significant, and full coverage ensures that you're not left footing the bill out of pocket. Additionally, if you live in an area with high rates of theft, accidents, or severe weather, full coverage insurance provides an extra layer of protection.

On the other hand, if you drive an older vehicle with a low market value, you might consider whether the cost of full coverage insurance is worth it. In some cases, the premiums for full coverage insurance State Farm may exceed the value of your vehicle, making liability-only coverage a more cost-effective option. It's also important to evaluate your financial situation and risk tolerance. If you have savings set aside to cover potential repair or replacement costs, you might opt for a less comprehensive policy.

Ultimately, the decision comes down to your unique circumstances and priorities. Full coverage insurance State Farm offers peace of mind and comprehensive protection, but it's essential to weigh the benefits against the cost. By carefully considering your needs and consulting with a State Farm agent, you can make an informed decision that aligns with your goals.

How to Save on Full Coverage Insurance

While full coverage insurance State Farm offers excellent value, there are several ways to make it more affordable. One of the easiest ways to save is by taking advantage of State Farm's discounts. The company offers a variety of discounts, including safe driver discounts, bundling discounts, and discounts for students with good grades. By combining these savings opportunities, you can significantly reduce your premium.

Another way to save is by maintaining a clean driving record. Drivers with a history of accidents or traffic violations typically pay higher premiums, so practicing safe driving habits can help keep your costs down. Additionally, consider increasing your deductible. A higher deductible means you'll pay more out of pocket in the event of a claim, but it can lower your monthly premium. Just be sure to choose a deductible that you can comfortably afford.

Finally, bundling your auto insurance with other types of insurance, such as home or life insurance, can lead to additional savings. State Farm offers competitive rates for bundled policies, making it a smart option for those looking to maximize their savings. By exploring these strategies, you can enjoy the benefits of full coverage insurance State Farm without breaking the bank.

Frequently Asked Questions

What is the difference between full coverage and liability-only insurance?

Full coverage insurance State Farm includes liability coverage, collision coverage, and comprehensive coverage, providing comprehensive protection for your vehicle. Liability-only insurance, on the other hand, only covers damages or injuries you cause to others in an accident. It does not cover repairs to your vehicle or non-collision-related incidents like theft or vandalism.

Can I customize my full coverage insurance policy?

Yes, State Farm allows you to customize your full coverage insurance policy to suit your specific needs. You can adjust your coverage limits, add extras like roadside assistance or rental car reimbursement, and take advantage of discounts to create a policy that works for you.

How do I file a claim with State Farm?

Filing a claim with State Farm is straightforward. You can file a claim online through the State Farm website or mobile app, or you can contact your local agent for assistance. State Farm also offers 24/7 customer support to help you through

Mastering The Art Of Baking: How To Know If Cookies Are Done

Exploring The Power Of A Nixcoders.org Blog: Your Ultimate Guide To Coding Excellence

What Is McAfee? A Comprehensive Guide To Cybersecurity Solutions

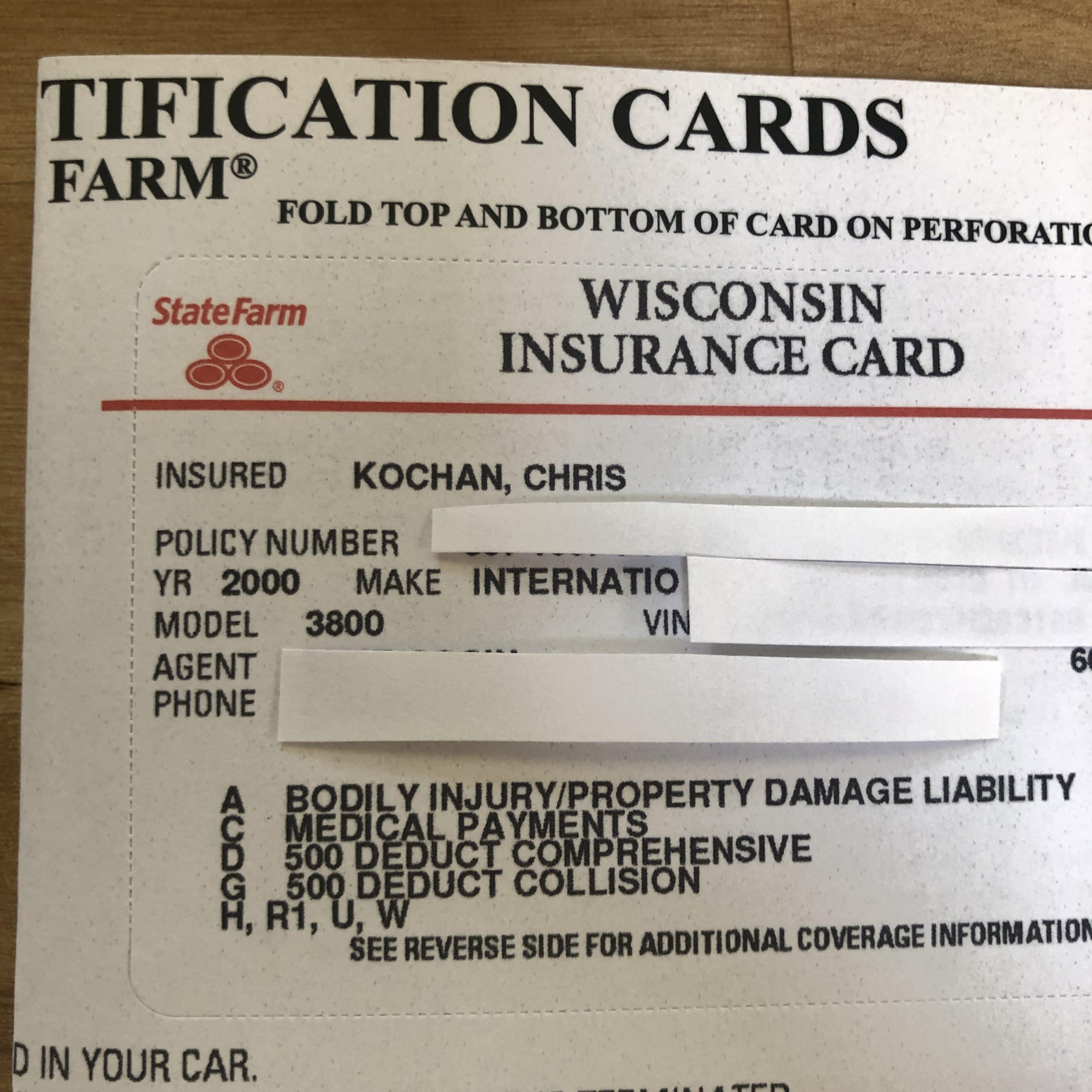

State Farm Full Coverage Insurance State Farm Insurance Card Fill

What Does State Farm Full Coverage Auto Insurance Cover?(Costs