Indiana Unclaimed Funds Reporting: A Comprehensive Guide To Reclaiming Lost Assets

Whether it’s a dormant bank account, uncashed checks, or forgotten insurance policies, the state of Indiana holds a vast repository of unclaimed property. Understanding how to navigate this process can make a significant difference in reclaiming your lost assets. In this guide, we will explore the intricacies of Indiana unclaimed funds reporting, offering step-by-step instructions and insights to help you reclaim your money. Indiana unclaimed funds reporting is not just about retrieving lost funds; it’s about reclaiming a piece of your financial history. The Indiana Attorney General’s Office oversees the Unclaimed Property Division, which is responsible for safeguarding these assets until they are claimed by their rightful owners. Every year, thousands of Hoosiers successfully recover their unclaimed funds, but many remain unaware of the process or how to get started. This article aims to demystify the process, providing you with the tools and knowledge needed to navigate the system effectively. From understanding what constitutes unclaimed property to filing a claim, we’ll cover all the essential steps. Reclaiming your unclaimed funds can be a straightforward process if you know where to look and how to proceed. Indiana unclaimed funds reporting ensures that individuals and businesses can access a centralized database to search for their lost assets. With the right guidance, you can avoid common pitfalls and maximize your chances of a successful claim. This guide will walk you through the entire process, from identifying unclaimed property to submitting your claim and following up with the state. Let’s dive into the details and explore how you can take advantage of this valuable resource.

Table of Contents

- What Are Indiana Unclaimed Funds?

- How Does Indiana Unclaimed Funds Reporting Work?

- Is There a Deadline for Claiming Unclaimed Funds in Indiana?

- Step-by-Step Guide to Searching for Unclaimed Funds

- Common Mistakes to Avoid When Filing a Claim

- How Can You Prevent Your Assets from Becoming Unclaimed?

- What Resources Are Available for Indiana Unclaimed Funds Reporting?

- Frequently Asked Questions About Indiana Unclaimed Funds

What Are Indiana Unclaimed Funds?

Indiana unclaimed funds refer to financial assets that have been abandoned or forgotten by their rightful owners. These assets can include dormant bank accounts, uncashed payroll checks, forgotten utility deposits, insurance payouts, and even stocks or dividends. When these funds remain inactive for a specific period—typically three to five years—they are turned over to the state under Indiana’s unclaimed property laws. The state then holds these funds indefinitely until the rightful owner or their heirs come forward to claim them.

Unclaimed funds are not just limited to individuals; businesses can also have unclaimed property. For instance, a company may have outstanding vendor payments or refunds that were never cashed. The Indiana Unclaimed Property Division ensures that these funds are protected and made accessible to their rightful owners. It’s estimated that one in ten Hoosiers has unclaimed property waiting to be claimed, making Indiana unclaimed funds reporting a crucial service for residents and businesses alike.

Read also:Jacob Lofland Net Worth Unveiling The Actors Career And Financial Journey

Types of Unclaimed Property in Indiana

- Dormant bank accounts

- Uncashed checks (payroll, refunds, etc.)

- Forgotten utility deposits

- Insurance payouts

- Unclaimed stocks and dividends

How Does Indiana Unclaimed Funds Reporting Work?

The process of Indiana unclaimed funds reporting begins when a business or financial institution identifies property that has been inactive for the legally required period. This could be a bank account with no activity, an uncashed check, or any other form of abandoned property. Once identified, the institution is required by law to report the unclaimed property to the Indiana Attorney General’s Office. The state then takes custody of the funds and holds them until the rightful owner comes forward to claim them.

Indiana unclaimed funds reporting is governed by the state’s unclaimed property laws, which are designed to protect the rights of property owners. The state maintains a centralized database where individuals and businesses can search for unclaimed funds. This database is updated regularly, ensuring that new claims are processed efficiently. To claim your unclaimed funds, you will need to provide proof of ownership, such as identification documents or account statements. Once your claim is verified, the state will release the funds to you.

Steps Involved in Indiana Unclaimed Funds Reporting

- Businesses identify and report unclaimed property to the state.

- The state reviews and verifies the reported property.

- Unclaimed funds are added to the state’s database.

- Individuals and businesses search the database for their unclaimed property.

- Claimants submit proof of ownership to the state.

- The state verifies the claim and releases the funds to the rightful owner.

Is There a Deadline for Claiming Unclaimed Funds in Indiana?

One of the most common questions about Indiana unclaimed funds reporting is whether there’s a deadline for claiming your funds. The good news is that there is no expiration date for claiming unclaimed property in Indiana. The state holds these funds indefinitely, ensuring that rightful owners or their heirs can claim them at any time. Whether it’s been a few years or several decades, you can still reclaim your lost assets through Indiana unclaimed funds reporting.

However, it’s important to act promptly if you suspect you have unclaimed funds. While the state holds these assets indefinitely, delays in claiming can lead to complications, especially if the original documentation is lost or outdated. Additionally, unclaimed funds can accumulate interest or dividends over time, making it even more advantageous to claim them sooner rather than later. By staying proactive, you can ensure that you don’t miss out on what’s rightfully yours.

Step-by-Step Guide to Searching for Unclaimed Funds

Searching for unclaimed funds in Indiana is a straightforward process, thanks to the state’s user-friendly online database. The first step is to visit the Indiana Unclaimed Property Division’s website, where you can access the search tool. Simply enter your name or the name of your business to see if any unclaimed funds are listed under your name. If you find a match, the next step is to gather the necessary documentation to prove your ownership.

Indiana unclaimed funds reporting requires claimants to provide proof of identity, such as a driver’s license or passport, as well as any supporting documents that establish your connection to the unclaimed property. This could include old account statements, canceled checks, or correspondence from the original holder of the funds. Once you’ve gathered your documents, you can submit your claim online or via mail. The state will then review your claim and, if approved, release the funds to you.

Read also:Discovering The Wild A Journey Through Timothy Treadwell Audio

Tips for a Successful Search

- Search using variations of your name (e.g., maiden name, nickname).

- Check for unclaimed funds under previous addresses.

- Include middle initials or suffixes (e.g., Jr., Sr.) in your search.

- Search for deceased relatives to claim their unclaimed property.

Common Mistakes to Avoid When Filing a Claim

Filing a claim for Indiana unclaimed funds reporting can be a smooth process if you avoid common pitfalls. One frequent mistake is submitting incomplete or inaccurate documentation. This can delay the verification process and even result in your claim being denied. To ensure a successful claim, double-check that all your documents are up-to-date and clearly legible before submission.

Another common error is failing to search thoroughly for unclaimed funds. Many people only search for their current name and address, overlooking potential matches under previous names or addresses. Additionally, some claimants neglect to check for unclaimed funds belonging to deceased relatives, which can be claimed by their heirs. By taking the time to conduct a comprehensive search and gather all necessary documentation, you can avoid these mistakes and maximize your chances of a successful claim.

How Can You Prevent Your Assets from Becoming Unclaimed?

Preventing your assets from becoming unclaimed is an essential step in safeguarding your financial future. One of the most effective ways to avoid this issue is to keep your contact information up-to-date with all financial institutions and businesses you interact with. This includes banks, insurance companies, utility providers, and employers. By ensuring they have your current address, you reduce the risk of your assets being classified as unclaimed.

Another proactive measure is to regularly review your financial accounts and statements. This includes checking for inactive accounts, uncashed checks, or forgotten deposits. If you notice any discrepancies or inactive accounts, take immediate action to address them. Additionally, consider consolidating old accounts or updating beneficiaries to ensure your assets are properly managed. By staying vigilant, you can prevent your assets from being turned over to the state through Indiana unclaimed funds reporting.

What Resources Are Available for Indiana Unclaimed Funds Reporting?

Indiana unclaimed funds reporting offers a variety of resources to help individuals and businesses reclaim their lost assets. The primary resource is the Indiana Unclaimed Property Division’s website, which provides a comprehensive search tool, detailed guides, and FAQs to assist claimants. Additionally, the state offers customer support via phone or email for those who need further assistance with their claims.

For businesses, the Indiana Attorney General’s Office provides guidelines and reporting tools to ensure compliance with unclaimed property laws. These resources help businesses identify and report unclaimed property accurately, reducing the risk of penalties or legal issues. External organizations, such as the National Association of Unclaimed Property Administrators (NAUPA), also offer valuable insights and tools for navigating the unclaimed property process. By leveraging these resources, you can streamline your efforts to reclaim or report unclaimed funds.

Frequently Asked Questions About Indiana Unclaimed Funds

How long does it take to process a claim for Indiana unclaimed funds?

The processing time for Indiana unclaimed funds reporting claims varies depending on the complexity of the claim and the completeness of the documentation provided. On average, claims are processed within 90 days, but more complex cases may take longer. To expedite the process, ensure that all required documents are submitted accurately and promptly.

Can I claim unclaimed funds on behalf of a deceased relative?

Yes, you can claim unclaimed funds on behalf of a deceased relative, provided you are the rightful heir or executor of their estate. You will need to provide documentation, such as a death certificate and proof of your relationship to the deceased, to support your claim.

Are there any fees associated with claiming unclaimed funds in Indiana?

No, there are no fees associated with claiming unclaimed funds through Indiana unclaimed funds reporting. The state provides this service free of charge to ensure that all rightful owners can reclaim their assets without financial barriers.

Conclusion

Indiana unclaimed funds reporting is a vital process that helps individuals and businesses reclaim their lost assets. By understanding how the system works and taking proactive steps to search for unclaimed property, you can recover what is rightfully yours. Whether you’re searching for dormant accounts, uncashed checks, or forgotten deposits, the state of Indiana provides the tools and resources needed to make the process as seamless as possible. Don’t let your hard-earned money go unclaimed—take action today and explore the possibilities of Indiana unclaimed funds reporting.

For more information, visit the Indiana Unclaimed Property Division.

Exploring The Myraid: A Comprehensive Guide To Understanding Its Impact And Applications

How To Master Bark Box Login: A Complete Guide For Pet Parents

Exploring The Magic Of Charlotte's Web Cast: A Comprehensive Guide

Are you owed unclaimed funds in Indiana?

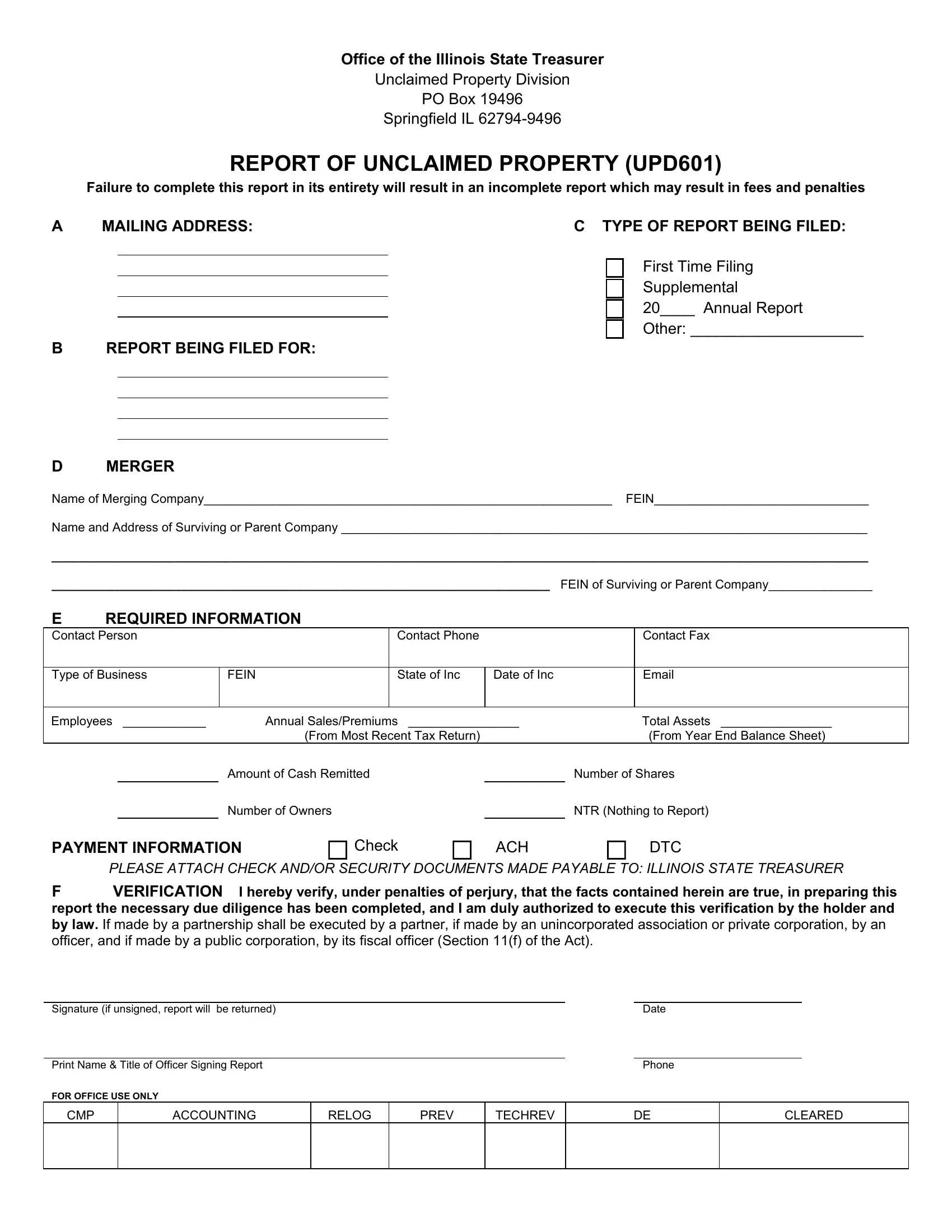

Illinois Unclaimed Property Reporting PDF Form FormsPal